Stability

across generations

Capital Gearing Trust was admitted to the London Stock Exchange in 1973 and has been managed by Peter Spiller since 1982. Under his leadership, the Company has delivered some of the strongest and most consistent performance among investment trusts. Alastair Laing joined as co-manager in 2011, followed by Chris Clothier in 2015, and together they continue to manage the Company with the same long-term, disciplined approach.

1963

Small

beginnings

Capital Gearing Trust was incorporated in Belfast in 1963 and listed on the London Stock Exchange in 1973.

It remained for many years a closely held investment vehicle, primarily designed to manage the capital of members, friends and business associates of a prominent Northern Ireland family. The driving force behind its formation was Major Cecil Harding, an Ulsterman who worked for a London stockbroking firm after service in the Second World War.

Over the following decades, the Trust’s distinctive approach and strong investment performance have seen it continuously grow.

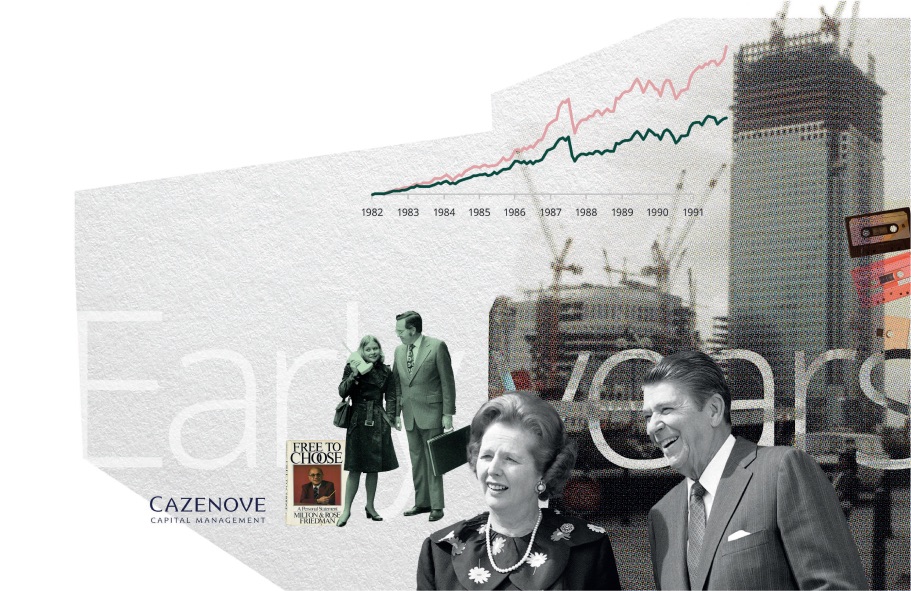

1982

The key appointment

In 1982, Peter Spiller took over management of what was then a small, family-run fund with less than £1 million in assets.

At the time, Peter Spiller had already spent 12 years working in the City, and today he is the longest-serving fund manager in the Investment Trust sector.

Economists who adhere to rational-expectations will never admit it, but a lot of what happens in markets is driven by pure stupidity – or rather inattention and misinformation about fundamentals.

Robert Shiller

1982

Spectacular

returns

Over the next 16 years from 1982 to 1998, the trust was able to enjoy quite spectacular returns, averaging 20%-30% per annum in many years. Both equities and bonds rose handsomely in value at the same time.

In 1988, a press article noted that Capital Gearing Trust was comfortably the best performing investment trust of all those listed on the London market, with gains of more than 1,250% over seven years, more than double the performance of every other comparable trust.

1985

Close

escape

In one of the more bizarre episodes in its history, in 1985 Capital Gearing received – but sensibly rejected – a bid approach from a notorious share ramping firm called Harvard Securities, whose founder Thomas Wilmot would later be jailed in 2011 for boiler room fraud.

Belfast, that troubled City, is the home of Capital Gearing Investment Trust. In this case small is beautiful as the company has been delivering an astonishingly profitable performance for its shareholders.

Evening Standard

June 1989

1990s

A new

direction

After the exceptional returns that the trust enjoyed in the long bull market that began in the 1980s, the mid to late 1990s marked an important turning point in the continued development of Capital Gearing Trust.

The first change was that the last of the mortgages which had provided the trust’s main source of gearing in the early years matured in 1998 and the principal repaid. After the exceptional performance of the trust over the previous 16 years, only a small minority of shareholders opted to cash in their gains.

A second factor was an important and lasting change in financial market conditions. The long bull market in equities, which was to run from the early 1980s through to 2000 with only two significant interruptions, was coming to an end.

Mid-1990s

A shift in

approach

Having become increasingly concerned about stock market valuations, by the mid-1990s Peter Spiller had already started to adjust the way that the trust’s portfolio was invested, increasing the holding of bonds of all types, including those attractive inflation linked bonds, and reducing the equity market exposure as the Internet bubble inflated. For the risk asset component of the portfolio, however, he continued to use his detailed in-depth knowledge and experience to winkle out gains from the most attractively priced investment trust shares.

We are concerned as much to protect value as to extract the last penny of capital gain.

2000

Going

independent

In 2000 Cazenove, ,the last surviving example of the private partnerships which had

once dominated the old City of London, announced that it would be giving up its unlimited liability partnership and was looking to float on the London market instead as a corporate entity.

This was the catalyst for Peter Spiller to decide to leave the firm where he had been a partner since 1994 and set up his own specialist independent fund management

business, with Capital Gearing Trust as its first and most important client.

Given his track record over nearly two decades, the board was more than happy to approve the appointment of CG Asset Management, as the new entity was to be called.

The client comes first. Don’t be greedy. Have fun

The CG Asset Management credo

borrowed from a former senior partner of Cazenove

2008

When risk

aversion pays

The value of the trust’s focus on capital preservation has never been shown to greater advantage than during the global financial crisis of 2008.

As banks imploded under a mountain of debt and worthless derivative securities, they dragged the world’s stock markets down by 50% over an 18 month period. Capital Gearing’s shareholders enjoyed positive returns all the way through, thanks to its careful defensive positioning and prescient warnings that a credit crisis was imminent.

The huge size of the derivative market, in particular the rapidly growing Collateralised Debt Obligations and CDO squared products, create a highly fragile financial system

Peter Spiller

May 2005

2015

Zero discount

policy

Apart from its competitive fees and strong track record, a powerful contributing factor driving the growth of the trust has been the adoption of the ‘zero discount policy’ which the board of Capital Gearing introduced in 2015 and has maintained ever since.

The flip side of a trust defending a discount successfully is the ability to issue new shares without diluting existing investors if the shares trade at a premium. Capital Gearing has been one of the most active secondary issuers of shares in recent years.

Shares

in demand

The flip side of a trust defending a discount is the ability to issue new shares without diluting existing investors when trading at a premium. Capital Gearing has been among the most active secondary issuers in recent years. While the management company gains higher fee income, shareholders benefit too, as costs are spread across a wider asset base, allowing management fees to reduce in stages.

Under this new policy the Company will purchase or issue shares to ensure – in normal markets conditions – that they trade as close as possible to their underlying NAV per share.

Graham Meek

Chairman, Capital Gearing Trust, 2015

2020

Inflation

concerns

Capital Gearing has been prominent in the last few years in highlighting the risk of higher inflation, given the policy of low interest rates, Quantitative Easing and other monetary stimulus measures.

“Monetary finance of government spending” warned the managers in 2020 “will not be deemed an issue so long as inflation does not rise to problematic levels. However, this very mindset significantly increases the risk of inflation actually becoming problematic”.

Behind the

consistency

Equity markets are cyclical and volatile, so trusts that avoid losses during sharp downturns are well placed to outperform over time. A trust losing 50% must double in value to recover, while one preserving capital and compounding steadily soon pulls ahead.

This has been Capital Gearing Trust’s pattern since 2000, compounding at around 8.4% per annum. While some trusts delivered sharper gains over short periods, by avoiding major drawdowns in 2000–2003, 2007–2009, and 2020, Capital Gearing has outpaced most peers over the long term.

New

opportunities

Peter Spiller points out that investment trust discounts remain narrow by historical standards, limiting opportunities seen in the 1980s. As discounts widen during bear markets, the best chances for outsized gains are unlikely until the next downturn.

The growth of ‘alternative asset’ trusts—investing in renewable energy, infrastructure, and shipping—has opened new opportunities. These sectors suit the investment trust model and offer stable, high single-digit returns, aligning with Capital Gearing’s absolute return focus.

Capital Gearing’s success hinges on asset allocation and correctly calling “the big picture.” Not every call has been perfect—the eurozone held together, and US equities led—but prioritising capital preservation has meant consistently being early in exiting bull markets.

We take the view that a commitment is a commitment and one you can’t just row back on.

Peter Spiller

explaining why he targets trusts that fail to implement their discount policies

2025

The way

ahead

Looking ahead, Peter Spiller, Alastair Laing and Chris Clothier will continue to guide Capital Gearing Trust with a disciplined focus on medium to long-term returns. With inflation likely to remain higher for longer, the managers believe the current cautious stance towards risk assets remains appropriate. However, they stand ready to increase exposure when prospective returns improve, aiming to protect and grow shareholders’ capital despite ongoing economic uncertainty.

Our Approach to Sustainability

Responsible strategies, long-term impact

Invest with confidence today

Our goal is simple: to protect and steadily grow your wealth over time, helping you stay ahead of inflation.